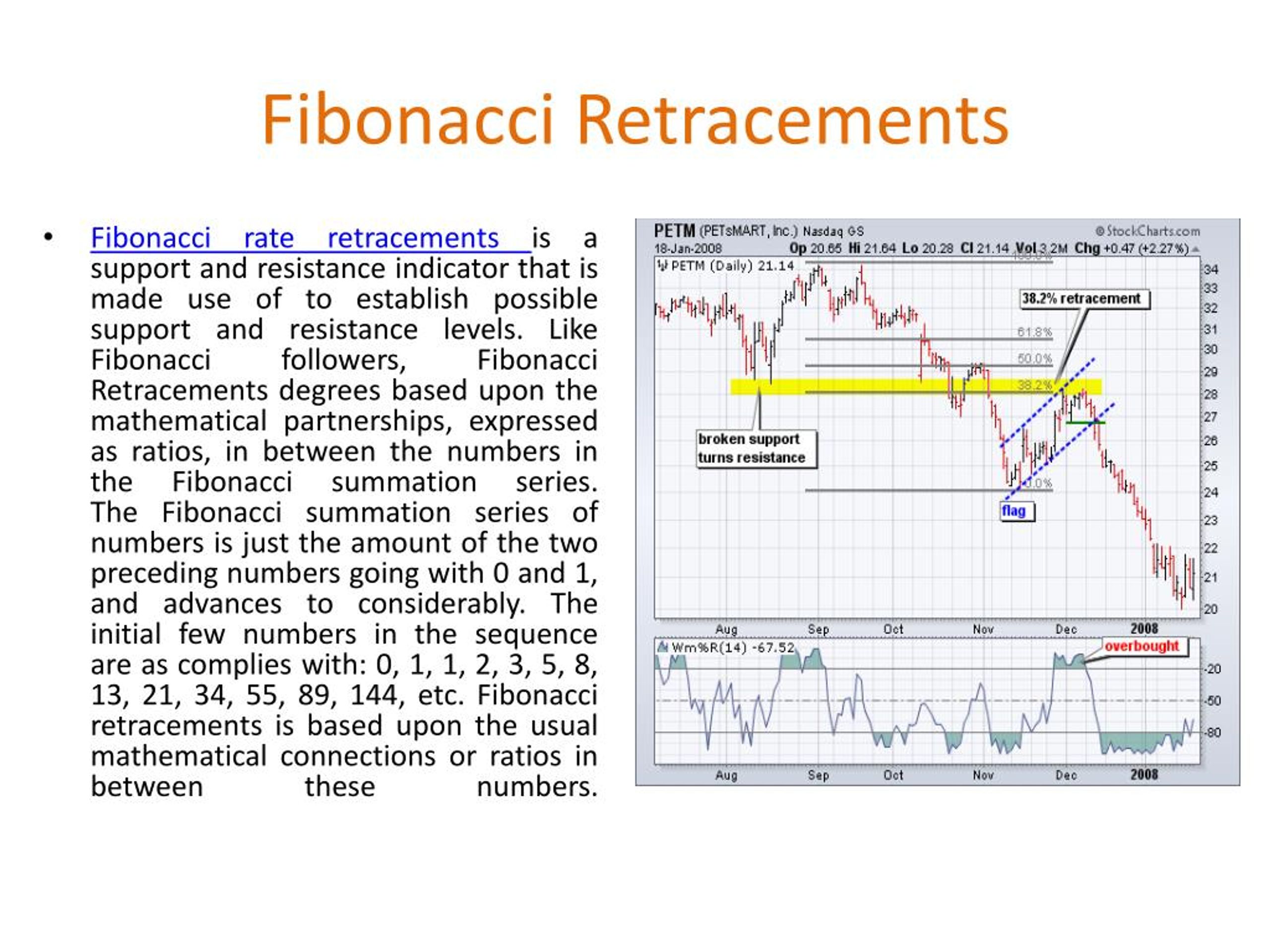

If you had some orders either at the 38.2% or 50.0% levels, you would’ve made some mad pips on that trade. The most important levels are 38.2% and 50% because, in this range, the breakout is most common.

What Are Fibonacci Levels & How To Trade With Them

What Are Fibonacci Levels & How To Trade With Them

1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377… you may have seen this sequence of numbers on a test, a puzzle or in popular fiction like the davinci code.

Fibonacci number forex. Regardless of whether an impulsive wave or a corrective one forms, fibonacci levels are the decisive factor for correctly counting waves. The phi number can be seen arts and even nature! When you divide a number by another two places higher, you will see the result to come as 0.382.

If you divide a number by the next number, the result may come as 0.618. 8/13 = 0.6153, and 55/89 = 0.6179. Fibonacci forex analysis fibonacci analysis is a great way to improve your analytical skills when trying to identify support and resistance levels.

If enough market participants believe. Fibonacci sequence in forex fibonacci levels are the 23.6%, 38.2%, 50%, 61.8% and sometimes 76.4% for some strategies. And you can continue this until it’s not fun anymore.

The 23.6% ratio is derived by dividing a number in the fibonacci series by number three on the right. 61.8% level is excellent for support or resistance. As you can see from this sequence, we need to start out with two “seed” numbers, which are 0 and 1.

Some of the fibonacci numbers are more important for forex traders. 23.60 and 38.20 are also important but not as the 0.618 derivatives. For the purposes of using fibonacci numbers for day trading forex, the key extension points consist of 61.8%, 261.8% and 423.6%.

Right, let’s learn this lingo. A fibonacci sequence is formed by taking 2 numbers, any 2 numbers, and adding them together to form a third number. What are fibonacci target levels?

Extensions use fibonacci numbers and patterns to determine profit taking points. This number represents the 38.2% fibonacci retracement. But this number is not only important in forex trading:

The fibonacci targets are great because they provide great exits in a trend. Indeed, 0.618, 61.80, 161.80 and 261.80 are the ones that work for us. In math this means ((a+b)/a) = phi.

The eurjpy forex pair sells off from 133.75 to 131.05 in just six hours, carving out a vertical trend swing that offers a perfect fit for a fibonacci retracement entry on the short side. Fibonacci retracement levels are represented by taking low and high points on a chart. Fibonacci levels are commonly used in forex trading to identify.

Important fibonacci levels in forex. The fibonacci sequence is as follows: It could be very helpful in order to choose the right direction and avoid entering to a wrong trade.

These particular sets of numbers can be found everywhere in nature, so it is believed that these particular numbers are relevant within the financial market. The ratios between these numbers can be found scattered throughout the world in various fields, and for many years, forex traders have used them to point out key price reversal occasions. It is is based on a progression series of numbers.

If you want to use the fibonacci numbers in the charts, you are required to find the top and the bottom of the previous trend. The fibonacci sequence is a series of numbers where each number in the series is the equivalent of the sum of the two numbers previous to it. These price corrections are temporary price reversals and don't indicate a change in the direction of the larger trend.

A fibonacci forex retracement, in general, is a short term price correction during an overall larger upward or downward movement. The 38.2% ratio is found by dividing one number in the series by the number that is found two places to the right. Now we can discuss about forex strategy hours and number that how traders can check numbers rating in forex market to see worth of pairs currency and check out that all matters are good in work, now we can see that how traders of trading strategy can work through this indicator patterns, this fibonacci retracement.

The idea to use fibonacci numbers in the charts is that you are able to find more supports and resistances. The fibonacci ratio of 61.8% is derived by dividing a number by the next number in the series. In these two examples, we see that price found some temporary forex support or resistance at fibonacci retracement levels.

Fibonacci levels are extremely important for a correct elliott count, and the patterns elliott identified are strongly related to these levels. Traders use this number as a fibonacci extension level. 987 / 1597 = 0.61803381 when you convert 0.61803381 to a percentage you get 61.803381% = 61.8%.

Before we look into the mechanics of fibonacci trading and how it translates into a forex fibonacci trading strategy, it is important to understand the fibonacci sequence and the unique mathematical properties it provides first. The key fibonacci ratios of 23.6%, 38.2% and 61.8% are marked horizontally for producing a grid. Then the second and third numbers are added again to form the fourth number.

Fibonacci forex trading strategies in action Fibonacci retracement levels are applied by marking the ratios of 23.6%, 38.2%, 61.8% horizontally between the highs and lows on a chart, to produce a grid. For instance, if the price started at $10, and it suddenly drops to $3.82, it has done a retrace, and this percentage is a retraced 38.2%, which is a number of the fibonacci retracement.

Extensions continue past the 100% mark and indicate possible exits in line with the trend. What are the golden ratio and fibonacci numbers? Fibonacci’s fascination with numbers led him to discover the mathematical sequence that bears his name (also known as the golden ratio).

Traders use this number as a 61.8% fibonacci retracement level. The fibonacci sequence is a sequence of numbers where, after 0 and 1, every number is the sum of the two previous.

Forex Technical Analysis Fibonacci O Que E Fx Trading

Forex Technical Analysis Fibonacci O Que E Fx Trading

/dotdash_Final_Top_4_FibonacciRetracementistakes_to_Avoid_Feb_2020-01-d3362598e0d140eb8b32a4425f1cc7b1.jpg) Fibonacci Forex System Top Nz Forex Brokers

Fibonacci Forex System Top Nz Forex Brokers

56 Forex Trend Strategy with Fibonacci Retracement

56 Forex Trend Strategy with Fibonacci Retracement

Fibonacci Retracement Know When to Enter a Forex Trade

Fibonacci Retracement Know When to Enter a Forex Trade

Fibonacci Retracement Intraday Forex System Learn Forex

Fibonacci Retracement Intraday Forex System Learn Forex

Fibonacci Forex Strategie Pdf « Top 3 aplikací s binárními

Fibonacci Forex Strategie Pdf « Top 3 aplikací s binárními

Application Of Fibonacci Number Forex Investing X

PPT Forex Market Guide PowerPoint Presentation, free

PPT Forex Market Guide PowerPoint Presentation, free

Metatrader 4 Mac Hugosway Candlestick Pattern Tekno

Metatrader 4 Mac Hugosway Candlestick Pattern Tekno

Fibonacci Everywhere! Fibonacci, Fibonacci number

Fibonacci Everywhere! Fibonacci, Fibonacci number

Fibonacci Retracement UNSW Forex Society

Fibonacci Retracement UNSW Forex Society

How Fibonacci Numbers are used in Forex? YouTube

How Fibonacci Numbers are used in Forex? YouTube

Using The Fibonacci Indicator To Trade Forexobroker

Using The Fibonacci Indicator To Trade Forexobroker

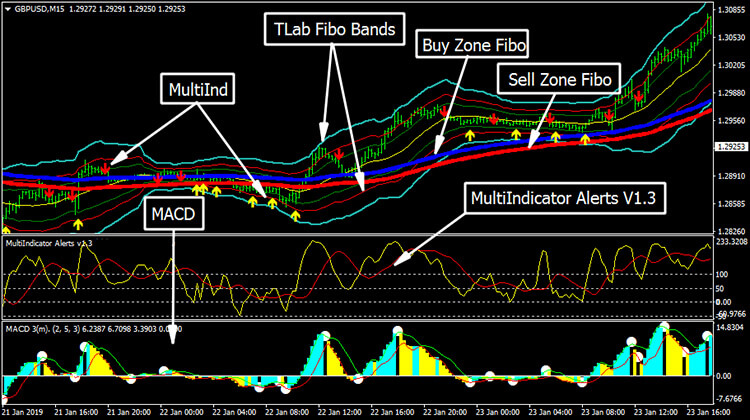

Fibonacci Bands Trading System Forex Download Forex

Fibonacci Bands Trading System Forex Download Forex

Urban Forex Fibonacci Forex Geek Ea Download

Urban Forex Fibonacci Forex Geek Ea Download

Fibonacci Strategy and How It Relates to Forex and Stock

Fibonacci Strategy and How It Relates to Forex and Stock

Fibonacci retracement forex indicator

How Fibonacci Retracement Indicator Works MyFxTools

How Fibonacci Retracement Indicator Works MyFxTools

0 Comments