So that completes my guide on how to avoid or minimize slippage in forex trading. Particularly in forex, where traders make fairly small profits on the average trade, slippage can wipe out an entire day's gain.

Typically, as price volatility increases, slippage (both positive and negative) occurs more frequently;

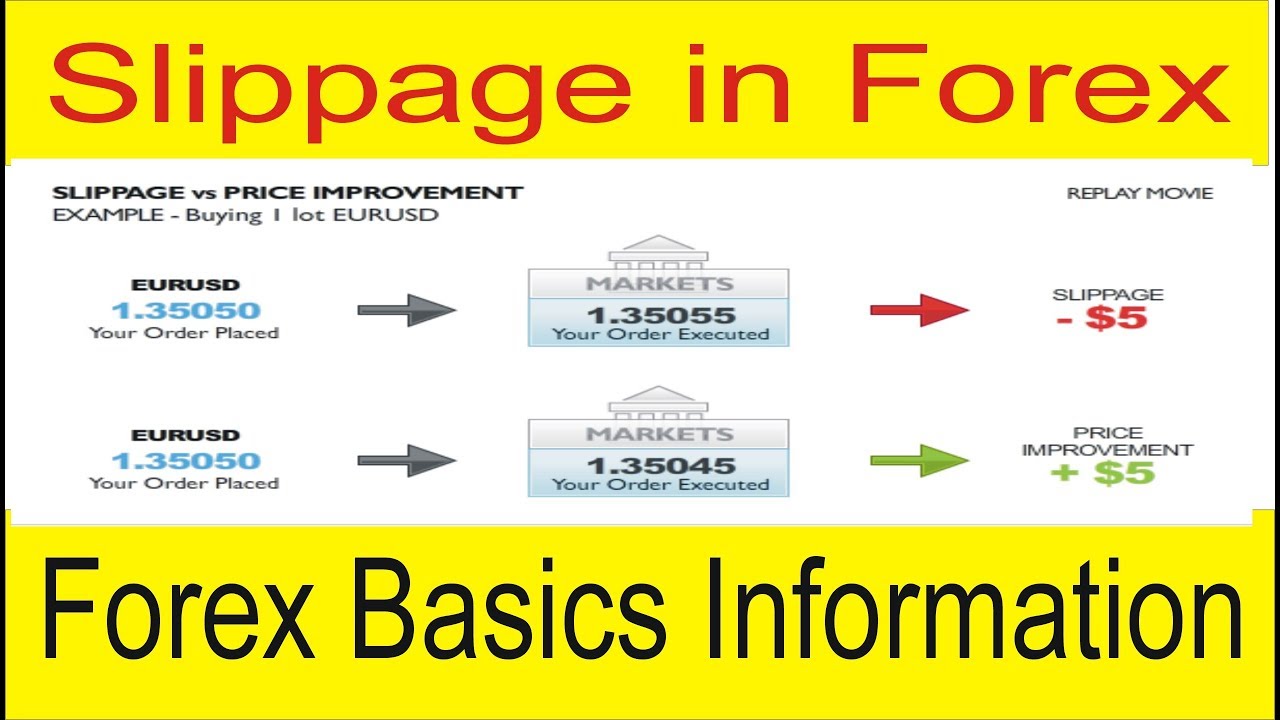

Slippage forex. Traders can, however, take precautions against slippage. Slippage is the difference between the expected price of a trade and the price at which the trade actually executes. Hiring a low slippage forex broker.

Algorithmic trading is often used to reduce slippage. Un slippage forex par exemple peut avoir lieu lorsqu'on lance un ordre d'achat eur/usd à 1.2300 et qu'il s'exécute à 1.2305. One of the ones that you will most certainly run into is what is known as “slippage.”simply put, slippage is a difference between the price you see and the price that you pay.

After we examined the forex brokers based on four important news events and found the top 10 for each of them, now it was time to find our final result which was the top 10 forex brokers for trading the news in total. Slippage inevitably happens to every trader, whether they are trading stocks, forex (foreign exchange), or futures. Slippage is more likely to occur.

Forex slippage occurs when a market order is executed or a stop loss closes the position at a different rate than set in the order. Slippage occurs when you place a trade in the market but get a different entry price to what you were expecting. Most brokers and brokerages will notify traders in their terms and conditions that slippage is possible and that they, as brokers, are exempt from possible spillage losses.

Contohnya, anda buy stop eur/usd di harga 1.3100, sebelum news release harga berada di kisaran 1.3070, (30 pip dibawah orderan buy stop anda). The best way to deal with slippage is to be vigilant and act fast. This is easier said than done, but professional slippage brokers adhere to all these points.

Market impact, liquidity, and frictional costs may also contribute. The term slippage is something you will often hear reference to if you are trading forex, or perhaps when you are researching with the intention of joining a new forex broker, or trying out a new trading platform. Forex entry orders and types of orders can be beneficial in the broader understanding of slippage and its use in forex.

Slippage is what happens when you get a different price than expected on an entry or exit from a trade. Slippage can occur for many reasons, but price volatility is often the largest contributor. For beginner traders who are only used to demo trading or theoretical trading from their studies, slippage is a nonexistent phenomenon.

Slippage and the forex market. Slippage is the difference between the expected price of a trade and the price at which the trade actually executes. When trading forex online, slippage can occur if a trade order is executed without a corresponding limit order, or if a stop loss is placed at a less favourable rate to what was set in the original order.

If you’ve only recently joined the ranks of live traders, the term order slippage might sound foreign. Dans ce cas, le trader subit un slippage négatif de 5 pips. What is slippage in forex and stocks?

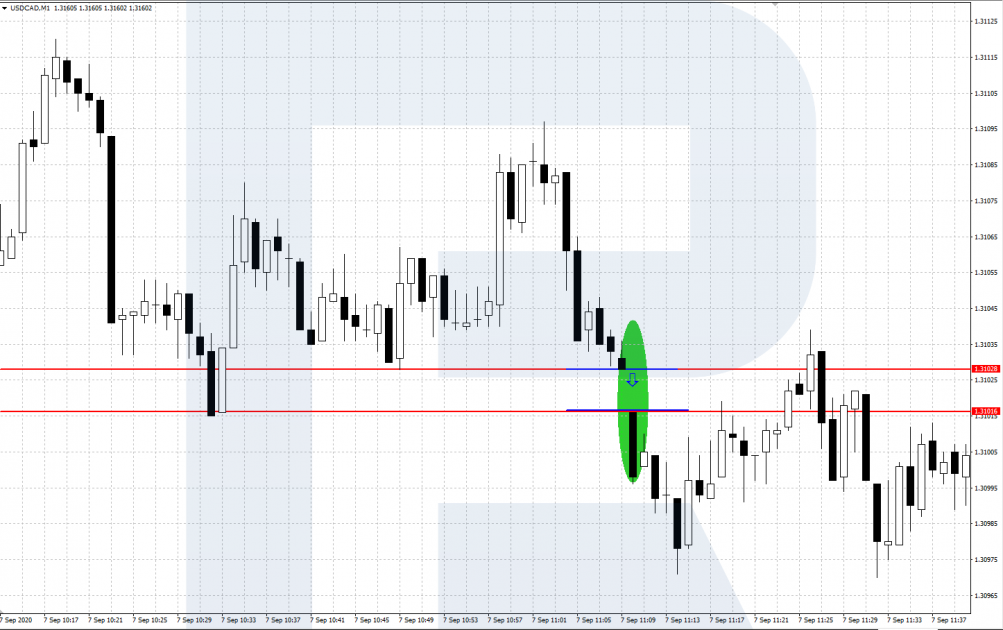

Dalam forex, istilah “slippage” mengacu pada saat ketika ada perbedaan antara harga yang diinginkan oleh trader saat melakukan order dengan harga sesungguhnya dimana order dieksekusi”. However, slippage should be regarded as a positive indication that the market and the trader's chosen market access, is operating in a transparent and efficient manner. Slippage itu dapat terjadi ketika pasar bergerak sangat kencang biasanya akibat news high impact, atau berita yang mempunyai dampak besar bagi pasar forex, seperti nfp.

Slippage, in trading terms, can best be described as having an order filled at a different price to the price initially quoted on the trading platform. Negative slippage can be a frequent occurrence depending on the type of market. Slippage, also referred to as execution risk, is a basic part of forex trading.

En effet, entre le moment où on passe l'ordre sur la plateforme de trading et son exécution sur le marché, il peut passer un très léger lapse de temps. When you begin to trade forex, you are inundated with a whole host of new terms. Dailyfx provides forex news and technical analysis on the trends that.

Best low slippage forex brokers for trading the news. It would only be advantageous to take a guaranteed stop loss your expected slippage is greater than the additional cost of the guaranteed stop loss. Slippage occurs during periods of high volatility,.

This is similar to taking a 4 to 20pip slippage in advance to guarantee your stop loss. This is, for example, why traders typically see more slippage around news events. As price volatility decreases, slippage occurs less frequently.

However, slippage should be regarded as a positive indication that the market and the trader's chosen market access, is operating in a transparent and efficient manner. Gain capital uk ltd is a company incorporated in england and wales with uk companies house number 1761813 and with its registered office at devon house. Digging a little deeper to define what slippage actually is, and the explanation is quite simple.

Forex slippage slippage, in trading terms, can best be described as having an order filled at a different price to the price initially quoted on the trading platform. Contohnya, kita melakukan order untuk buy pasangan mata uang eur/usd pada harga 1.1191, tetapi malah tereksekusi di harga 1.1195 (4 poin lebih tinggi). With regard to futures contracts as well as other financial instruments, slippage is the difference between where the computer signaled the entry and exit for a trade and where actual clients, with actual money, entered and exited the market using the computer’s signals.

Forex.com is a trading name of gain capital uk limited.

Forex Slippage Meaning Create Forex Ea Online

Forex Slippage Meaning Create Forex Ea Online

Definition For Forex Trading Forex Scalping Forum

Definition For Forex Trading Forex Scalping Forum

Slippage คืออะไร Forex Slippage

Slippage คืออะไร Forex Slippage

What is Slippage ? How to Avoid Slippage in Forex Trading

What is Slippage ? How to Avoid Slippage in Forex Trading

Forex Liquidity Slippage Forex Scalping On 1 Minute Chart

Forex Liquidity Slippage Forex Scalping On 1 Minute Chart

What is Slippage in Forex? R Blog RoboForex

What is Slippage in Forex? R Blog RoboForex

Forex 13 FXCM Slippage & price lag episode 3

Forex 13 FXCM Slippage & price lag episode 3

Slippage, Requotes and Unfair Price Execution How Big a

How to avoid or minimize slippage in Forex trading

How to avoid or minimize slippage in Forex trading

Forex Trading What Is Slippage And How to Avoid It

Forex Trading What Is Slippage And How to Avoid It

The Basics of Spread & Slippage Forex Academy

The Basics of Spread & Slippage Forex Academy

Slippage on Forex How to Reduce Your Losses

Slippage on Forex How to Reduce Your Losses

Slippage in Forex trading TriumphFX Analysis

Slippage in Forex trading TriumphFX Analysis

Forex Slippage Definition Simple Forex System That Works

Forex Slippage Definition Simple Forex System That Works

An Introduction to Forex Slippage FXCC Blog

What is Slippage in Forex Trading? How to Avoid It? FX

What is Slippage in Forex Trading? How to Avoid It? FX

0 Comments