Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events. @ there are essentially 3 popular hedging strategies for forex.

How Do Point Spreads In Forex Work Forex Hedging

How Do Point Spreads In Forex Work Forex Hedging

If you decide to trade binary forex hedging currency pairs option, trade on a u, cftc regulated binary option exchange uch a cantor exchange.

Forex hedging pairs. This strategy is a cinch to undertake, in that it only requires one to open a position going opposite to one’s current position. Clearly, this is a rather steep learning curve for most beginners. They profit when you loe forex hedging currency pairs o it i in their bet interet to bet againt you every ingle trade.

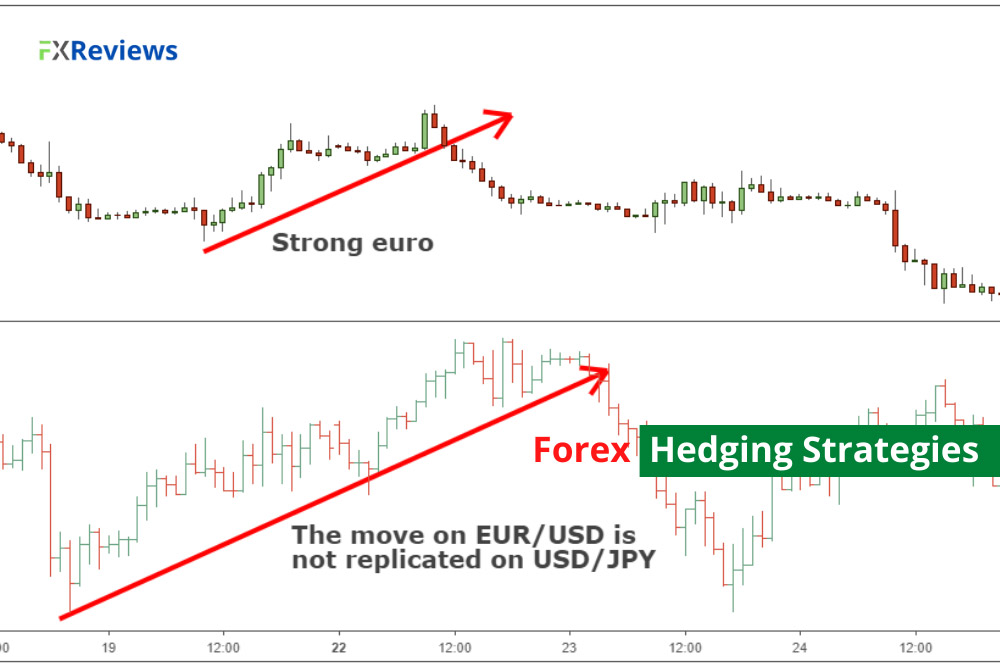

Euro and united states dollar both are the most stable currency pairs of the forex market and world. Another forex hedging strategy involves opening two long positions on two currency pairs that are negatively correlated. Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move.

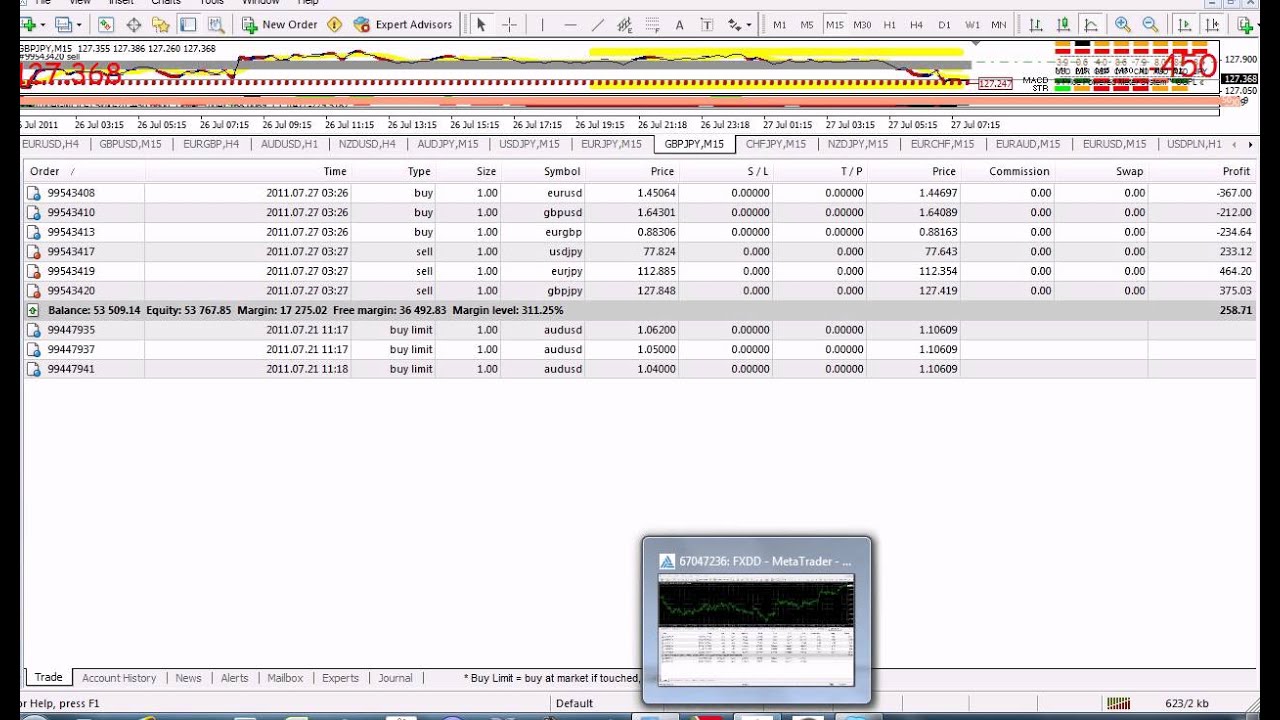

These pairs will give up 30 to 40 pips in a heartbeat. I would suggest looking for a forex broker with the lowest spreads on these pairs and that allows hedging (buying and selling a currency pair at the same time). A forex hedging robot is designed around the idea of hedging, which is based on opening many additional positions and buying and selling at the same time combined with trend analysis.

If we had to sum up hedging in as few words as possible, we could probably trim it down to just two: They never profit on your loe. To make the most effective use of a forex hedging strategy in this way, you really need to deal in multiple currency pairs, have a sound understanding of how they correlate and, more crucially, how this relationship can offset the movement of all the currency pairs in your portfolio.

That, in essence, is the thinking behind a forex hedging strategy. Hedging is amongst the most utilized strategies to reduce and manage risk. The pair nzdchf currently gives a net interest of 3.39%.

A forex trader can make a hedge against a particular currency by using two different currency pairs. There are many financial hedging strategies you can employ as a forex trader. Understanding the price relationship between different currency pairs can help to reduce risk and refine your hedging strategies.

Forex hedging is a common trading strategy that traders, as well as forex expert advisors, use to offset the risk of price fluctuations in the forex market.unlike other trading strategies such as scalping, trend trading, or positional trading, hedging seeks to reduce unwanted exposure to currencies from other positions. Using this free fx hedging tool the following pairs are pulled out as candidates. Now, if the euro falls against usd, your long position on gbp/usd takes a loss.

The basics on which a forex hedging robot works is the idea where you open many positions while buying and selling them at the same time while implementing trend analysis. 4) hedging isn’t a beginner’s cup of tea. It is super flexible and there are a ton of nuances to this method.

This is all done in order to protect yourself against sudden and unexpected market movements. Forex hedging is a method which involves opening new positions in the market in order to reduce risk exposure to currency movements. The classic definition of a hedge is this:

Pairs trading is an advanced forex hedging strategy that involves opening one long position and one short position of two separate currency pairs. I call my forex hedging strategy zen8. It means when the first pair is rising the second one faces a drop by a related number of points.

Euro is the currency of 19 countries of the world and it is not only the currency of europe but it is also the currency of the european union and it has 28 countries in it but only 19 countries use euro as the currency of their country. In this case, it wouldn't be exact, but you would be hedging your usd exposure. Forex hedges are used by a broad range of market participants.

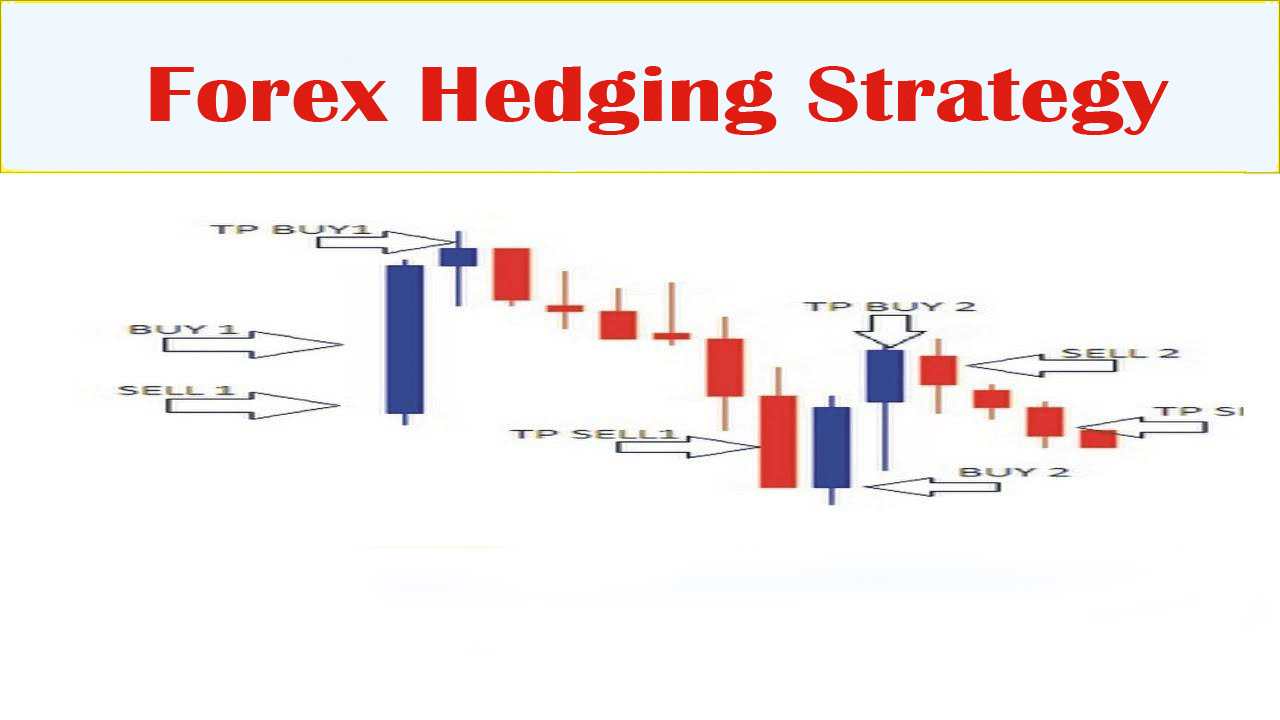

Therefore, if patience isn’t your thing, forex hedging might not be for you. Let’s take a look at the simplest strategies that traders employ. Traders, as well as forex robots, deploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open position.

A position taken by a market participant in order to reduce their exposure to price movements. The forex hedging strategy, in this case, will look like this: Hedging as it applies to the forex market and trading, at its most basic form, is a strategy to protect you from losing big in a certain market position.there are many types of hedge that move from the very simple, to the more complex if you are an advanced trader, but the premise is the same.

For a hedge to be successful, it must incorporate other forex trading strategies. So, the lower the spread you pay for these pairs, the better. Forex hedging strategy using two currency pairs.

For example, eurusd and usdchf have a strong negative correlation. Now we need to find a hedging pair that 1) correlates strongly with nzdchf and 2) has lower interest on the required trade side. Gbpusd = buy usdchf = buy gbpchf = sell or gbpusd = sell usdchf = sell gbpchf = buy i used no indicator at all, but it took sometimes a while to get.

For example, you take a short position on eur/usd and open a long position on gbp/usd. For example, a trader can open a long gbp/usd, usd/jpy. Nowadays, the first method usually involves the opening positions on 3 currency pairs, taking one long and one short position for each currency.

This way, although forex is prone to sudden changes, depending on what’s happening in the world, you are still trying to create the most “positive” place in the market. For example, you could buy a long position in eur/usd and a short position in usd/chf. A forex hedge is a transaction implemented to protect an existing or anticipated position from an unwanted move in exchange rates.

I will share these details with you in later blog posts. The core of my forex hedging strategy. Practically, forex hedging seems to work best in the long term.

Never trade binary forex hedging currency pairs option with an otc broker. Forex hedging is, therefore, the process of trying to offset the risk of. When hedging two currencies, you two take positively forex pairs that correlate and take positions on them in opposite directions.

It is used to know the next trading movement in market trading.the forex hedging strategy matches with the two trading strategies that is in the two same currency pairs place a hedge in an opposite position and the second is purchase forex options for h4 trading strategy.the second strategy is jsed for both long term and short term time period.

Forex Hedging Trading Strategies (2020 Guide)

Forex Hedging Trading Strategies (2020 Guide)

Forex Hedging Pairs Best Forex Trading System Free Download

Forex Hedging Pairs Best Forex Trading System Free Download

Forex 3 Pairs Hedging Forex Gann System No Repaint

Forex Hedging Strategy Two Currency Pairs Is The Best

Forex Hedging Strategy Two Currency Pairs Is The Best

Top Forex Hedging Strategies and its Dynamics Fxreviews.best

Top Forex Hedging Strategies and its Dynamics Fxreviews.best

Forex Correlation Pairs Strategy Forex Free Trading System

Forex Hedging Dual Grid Strategy Market Neutral Forex

Forex Hedging Dual Grid Strategy Market Neutral Forex

3 Pair Hedge EA System Forex Free Robot Download

Forex Hedging Strategy Two Currency Pairs Is The Best

Forex Hedging Strategy Two Currency Pairs Is The Best

Forex Correlation Hedge Ea Reversal Krieger V2 Forex

Forex Correlation Hedge Ea Reversal Krieger V2 Forex

Inverse pair hedging Forex Factory

Forex hedging technique trading workflow example FREE

Forex hedging technique trading workflow example FREE

Hedging Forex Pairs Market Live Analysis

Hedging Forex Pairs Market Live Analysis

The "SureFire" Forex Hedging Strategy Learn Forex Trading

The "SureFire" Forex Hedging Strategy Learn Forex Trading

Forex 3 Pairs Hedging Forex Gann System No Repaint

Forex 3 Pairs Hedging Forex Gann System No Repaint

Successful Forex Hedge Strategy that Makes Money YouTube

Forex 3 Pairs Hedging Forex Ea Crack

Know About the Hedging in Forex AAG Markets

Know About the Hedging in Forex AAG Markets

0 Comments